Factoring Notification Bluevine-Style: What You Need To Know

Bluevine has partnered with FundThrough for invoice factoring

Free up your cash flow and apply for invoice funding on FundThrough’s website.

Apply now

Congratulations, you’ve recently discovered invoice factoring as a fast and convenient way to deal with those cash flow gaps.

Instead of having to wait 30, 60, or even 90 days for your customers to settle their bills, you’re able to get quick access to capital trapped in your unpaid invoices through a funding partner.

With a factoring credit line, your customer sends payments directly to your funding partner when they’re ready to pay. To allow this new process to happen, your remittance information must be updated with your customer. This is done through a notification letter your funding partner generates and sends out. It’s important to understand what this document means.

Some business owners may worry such notice can disrupt their relationship with their customers. That may be true with some traditional factoring companies which require you turn over a big chunk of your receivables.

But that’s not the Bluevine way.

Invoice factoring Bluevine-style is dramatically different. It’s better for you as well as for your customers. The most important reason is simple: Bluevine will not require you to relinquish total control of your customer relationship.

We strive to make the notification process non-intrusive and sensitive to your needs as a business owner and the needs of your customers.

Once you’ve been approved for a factoring credit line, you get a dedicated Bluevine account manager. Your account manager is there to help you reach out to your customers and explain the Bluevine process.

Again, one point is worth stressing here: With Bluevine, you can maintain a great deal of control in this process. Here’s why:

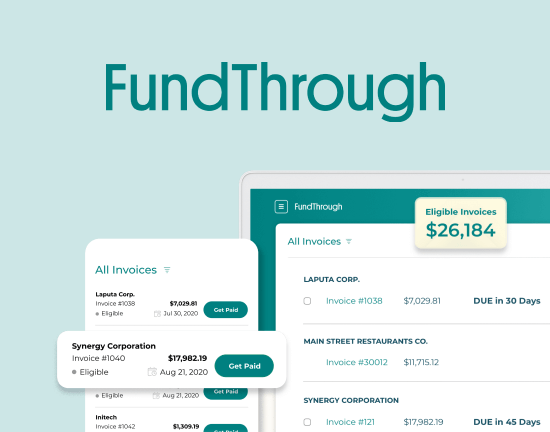

1. You can pick and choose the invoices to fund through our user-friendly dashboard

When you’re approved for a Bluevine factoring line, you get a personalized bank account and a P.O. Box address for your customers to send their payments.

Once we notify your customer, payments will start to flow through these accounts.

When payments are received, Bluevine matches it to your account. We will deduct the balance owed on that invoice and any remaining funds will be quickly forwarded straight to your bank account.

Although all payments are processed through your Bluevine account, you still get to choose which invoices you’d like to submit for funding.

Here’s how that works: If we receive a payment on an invoice you didn’t fund with us, our Payments Team will pass through the funds straight to your bank account. We call these “Pass-Through” invoices.

You also get to choose the customers whose invoices you’d like to submit for funding. This is yet another way Bluevine gives you more control over the notification process and relationship with your customers.

2. You can take the lead by preparing your customers for the change

We understand your business relationships are important, which is why we will make it a point to involve you in the process of setting up the new payment arrangements.

You could potentially even take the lead in notifying your customer if you think it would be more beneficial to your business. In fact, utilizing your relationship with your customer and reaching out to them before we email them would help. This will prepare your customers for what we need and help us avoid any confusion about our process. Bluevine values and encourages transparency in our funding process, and involving your customer early on is one way to accomplish this.

3. Your Bluevine account manager is there to assist you

You will work with a dedicated Account Manager who will help make sure your invoice factoring account is set up properly.

Your account manager works with you to get the Notification Letter out to your customer and to confirm the remittance change. They will also help you avoid a common problem: misdirected payments. That’s when your customer sends the payments to the wrong bank account or mailing address.

By avoiding misdirected payments, you’re able to build positive payment history with Bluevine. This can help your account manager work with our underwriters to get you an increased credit line in the future.

It’s also important to note that some of your customers may already be familiar with traditional factoring, which is a widely-used financing option.

In that case, the only point you may want to stress to them is how factoring Bluevine-style is more transparent and convenient for both borrowers and their customers.

More from the Bluevine Business Blog

Invoice Factoring Basics: How To Pick An Invoice Factoring Company

Business Line of Credit: A Smart Financing Option for Entrepreneurs