Finding an efficient way to monitor finances and cash flow can contribute significantly to the success of any business. One way to organize business expenses and finances is by using business checking sub-accounts.

Think of sub-accounts as having multiple business checking accounts, but in one centralized place. A sub-account can break down your main account into several different spending categories. With sub-accounts, businesses can easily keep track of incoming and outgoing cash, creating a seamless way to allocate funds based on specific needs and business goals. This also helps give you an organized financial snapshot of your business at any given time.

Just like your main bank account, sub-accounts allow you to initiate transactions at any time. You can also send and receive payments, view all transactions, and receive a separate statement for each sub-account.

You can set up sub-accounts in a way that best fits your business’s needs. For example, they can be used for income, or to organize business expenses, such as recurring payments, payroll, incoming payments, outgoing payments, or individual projects.. Here are several ways that organizing your money with sub-accounts can help you better manage your business finances.

Increase profit over time.

Sub-accounts can help your business increase profit over time when used in conjunction with the Profit First method. Traditionally, a business’s profits are equal to its income minus its expenses. With the Profit First Method, profit is subtracted from a business’s income first, and then whatever is left is allocated for expenses. From there, you make decisions for scaling your business based on the money left over after you’ve accounted for profit. By having a dedicated sub-account for profit and other cash buckets that tie into the Profit First accounting approach, you can streamline your accounting and guarantee that you stick to the required allocations to achieve success and growth with this strategy.

Separate personal and professional transactions.

Separating personal transactions from business transactions but still having access to all the money in one place is particularly useful if you are self-employed or work as a freelancer. If this is the case, you will have fewer business financial transactions, so an option is to open up one main account for business and have a sub-account for personal transactions. Using sub-accounts separates business transactions from personal transactions, making it easier when tax time rolls around.

Simplify the management of travel expenses.

Most companies provide employees with corporate cards so that they don’t have to cover business expenses using their personal finances. However, you can set up a sub-account for travel expenses for all hotels, transportation, and meals and use it to reimburse costs. Sub-accounts allow you to keep all travel expenses separate and keep close tabs on your travel budget.

Have teams independently manage their projects.

If your company has independent teams, then most likely each team has an independent budget. Using sub-accounts could allow you to set funds aside for each team and it might make it easier for department heads to manage their budgets. You can save yourself time and energy by no longer having to give approval for each budget-related decision. The one caveat here is that this budgeting method might require quite a few sub-accounts, depending on the size of your organization.

Separate passive income from active income.

Since your company can earn money in various ways, it’s helpful to separate the different income flows. For example, a bucket for passive income would include the sale of digital goods, cash-back programs, and affiliate marketing. Meanwhile, a separate bucket might include cash from the sale of physical products or specific services. Sub-accounts keep this information at your fingertips which is great to have on hand as you plan and forecast.

Plan ahead for taxes.

Every company pays taxes throughout the year, whether it’s sales tax, income tax, corporate tax, or any of the other vast and varied taxes businesses are responsible for paying. Creating a sub-account to set aside funds for taxes makes those tax bills a little less intimidating and helps keep your business finances organized and on track. It also helps ensure that you don’t get hit with any surprises come tax season.

Save funds for future investments.

Setting aside funds to invest in the continued growth of your business is an excellent example of how sub-accounts can help you transform and scale your company. Many times, it can be difficult to invest money back in your business without having a plan in place or saving with that goal in mind. A dedicated sub-account for growth-related investments can be a good way to ensure that you allocate these funds right away so as not to dip into them for everyday expenses.

Ensure a safety net of liquidity.

No matter how well your business may be doing, there will always be unavoidable, and sometimes costly, bumps in the road. Using a sub-account, you can plan for the unforeseen. Set aside money regularly to provide yourself with a safety net to cover the challenges that will inevitably come your way. Having this money set aside will give you peace of mind and help you learn to operate and plan for your business while accounting for that allocation on a monthly or recurring basis. In the end, it could be the difference between failure and success for your company.

Organization is simple in theory but not as easy to initiate and maintain. Sub-accounts for business checking are a great way for business owners to organize business expenses and manage money better, which in turn sets you up for success.

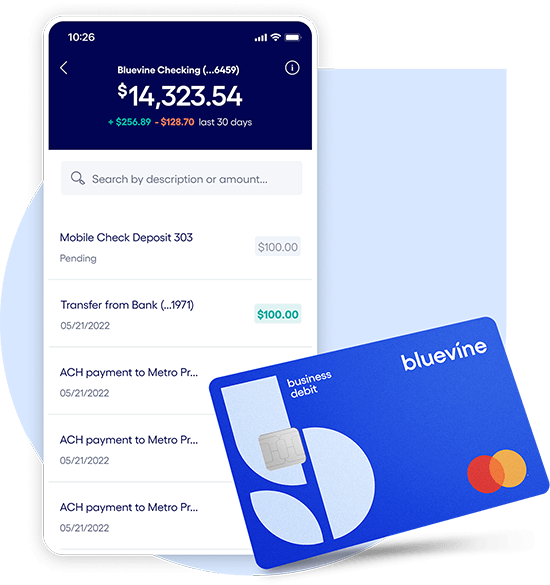

Small business checking, built for your needs

Unlimited transactions, live support, high-interest rates, and no monthly fees. Open a Bluevine Business Checking account online today.

Learn more